Introduction

When a group of companies prepares consolidated financial statements, intercompany transactions need to be eliminated. This ensures that revenues, expenses, assets, and liabilities are not double counted across the group entities. Intercompany elimination involves adjusting financial statements to remove the impact of transactions that occur between companies within the same group. This adjustment is crucial for providing an accurate picture of the group’s overall financial performance and position in the consolidated financial statements.

Let us understand with the help of an example.

Example 1

Transactions:

- India Ltd. sold goods worth 1,000 to China Ltd.

- India Ltd. sold goods worth 2,000 to France Ltd.

- India Ltd. sold goods worth 3,000 to Germany Ltd.

- India Ltd. sold goods worth 10,000 to External Party.

- Germany Ltd. sold goods worth 1,000 to France Ltd.

- China Ltd. sold goods worth 1500 to External Party.

- France Ltd. sold goods worth 5000 to External Party.

- Germany Ltd. sold goods worth 6000 to External Party.

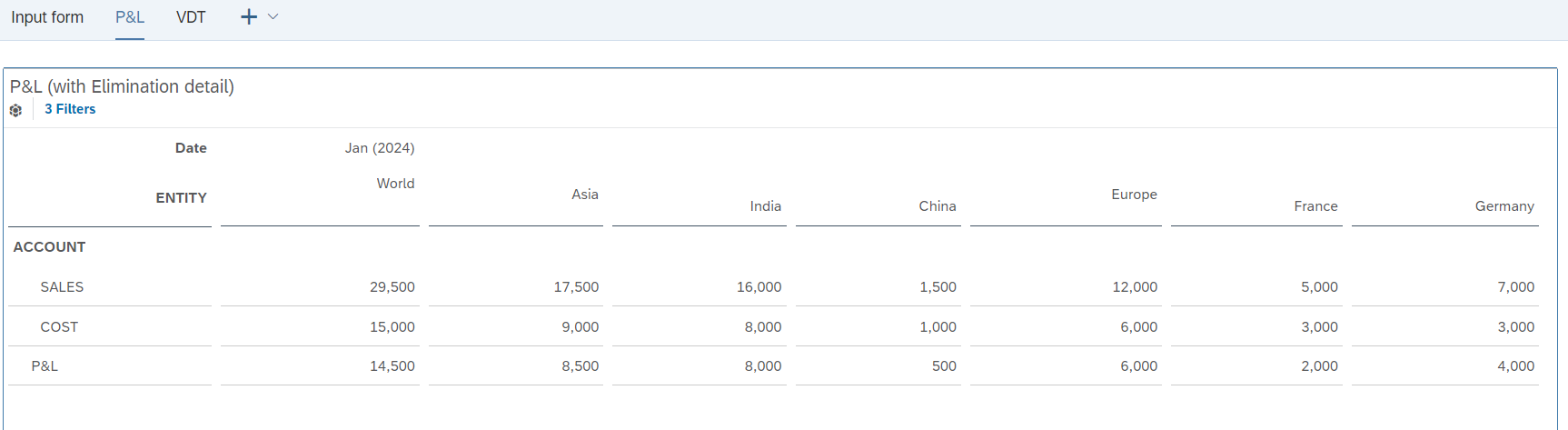

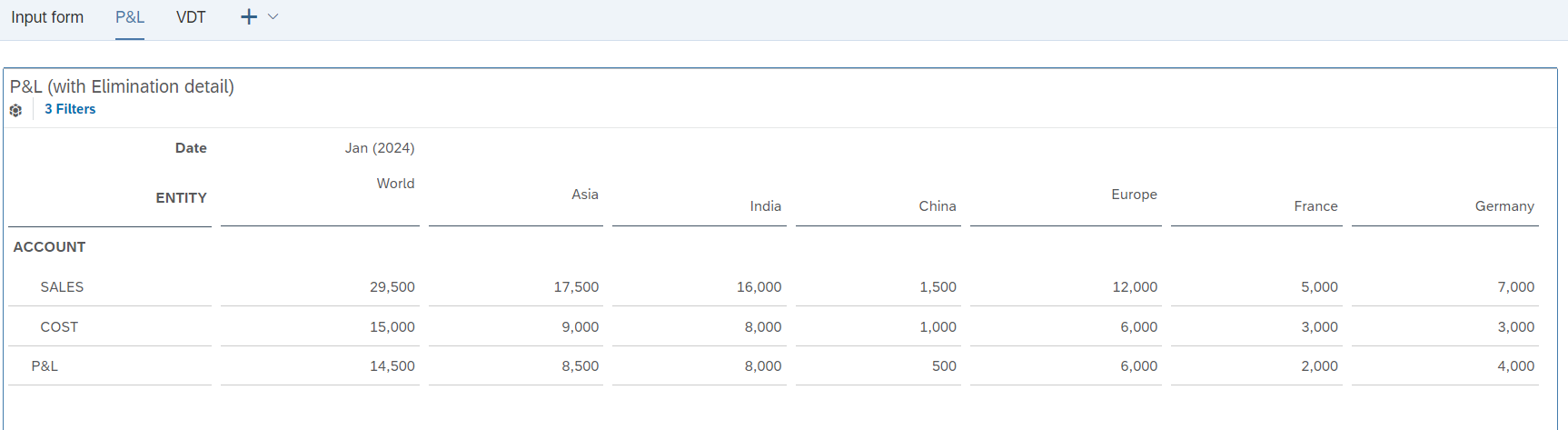

Below Screenshot shows the above transactions as entered in SAC input form.

Requirement

Transactions between companies within the same group can lead to duplication of revenues and expenses if not properly accounted for. To prevent this, the financial statements of each individual company within the group are adjusted to eliminate the impact of these internal transactions. This adjustment ensures that such transactions do not distort the consolidated financial statements, making them appear as if they were transactions with external parties.

In transaction1, an India Ltd has sold to a China Ltd., In this transaction, we want the sales entry at the Indian level to be eliminated by posting a corresponding -ve value in “Elim_Asia” to negate its effect on Asia Level.

For Transaction 2 and 3, we want elimination to happen at World level.

For Transaction 5, We want elimination to happen at Europe level.

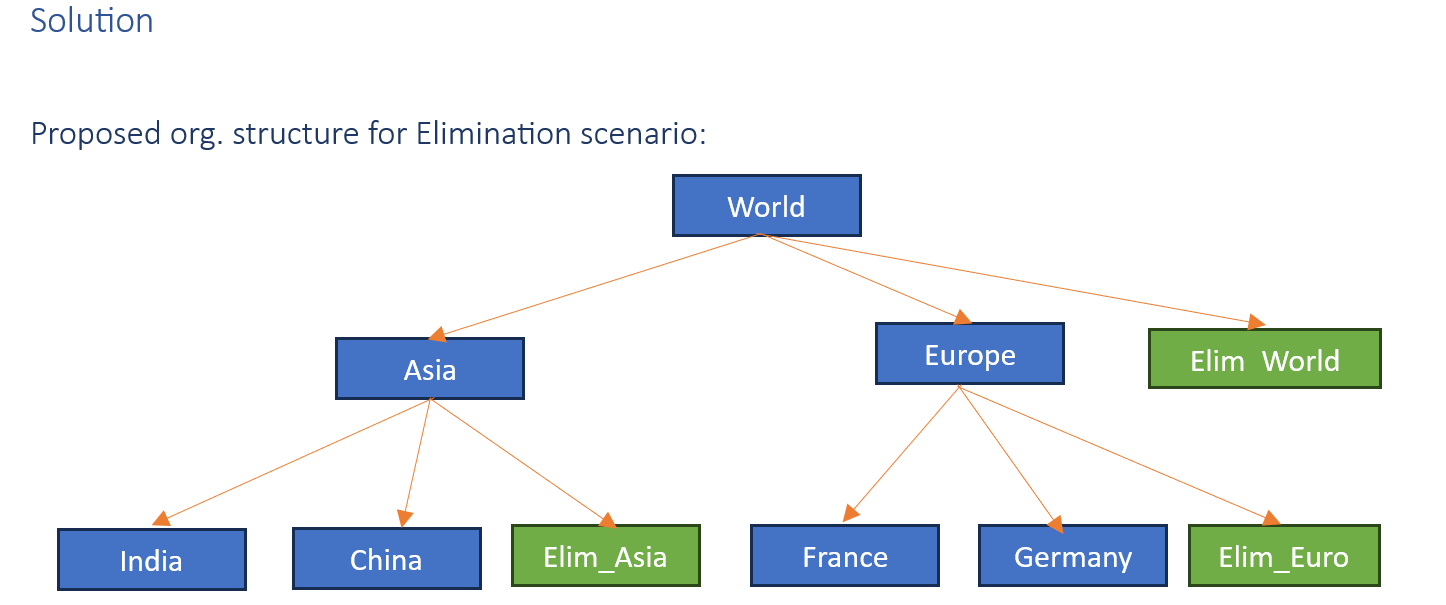

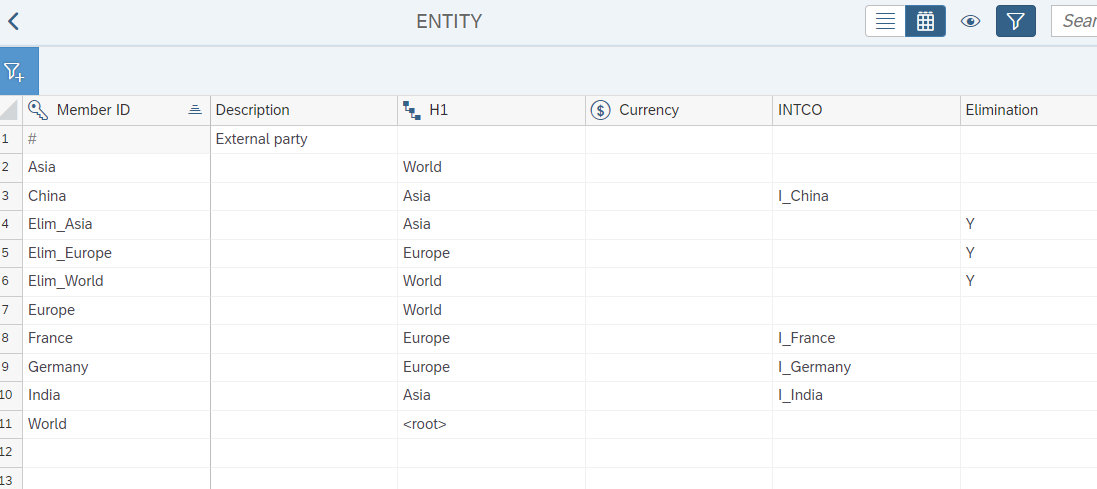

Step 1 – Entity Dimension

- Prepare the Entity dimension with the dimension type as “Organization.”

- Create members: Elim_Asia, Elim_Europe, Elim_World. (These will function as members holding eliminated values)

- Create INTCO property & maintain the Intercompany member ID of respective Entity.

- Maintain the “Elimination” property; set ‘Y’ to indicate yes.

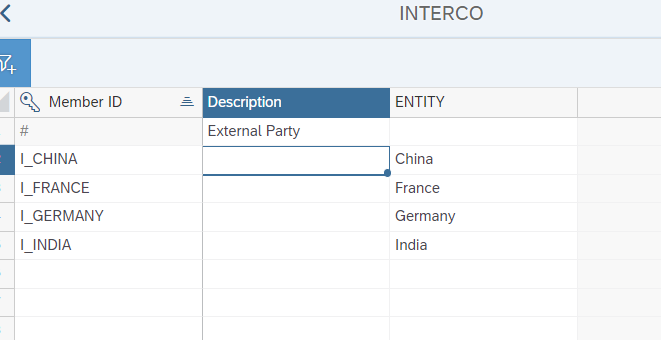

Step 2 – Intercompany Dimension

- Prepare the intercompany dimension with the dimension type as “Generic”

- Maintain the “Entity” property; include the ID of the Entity.

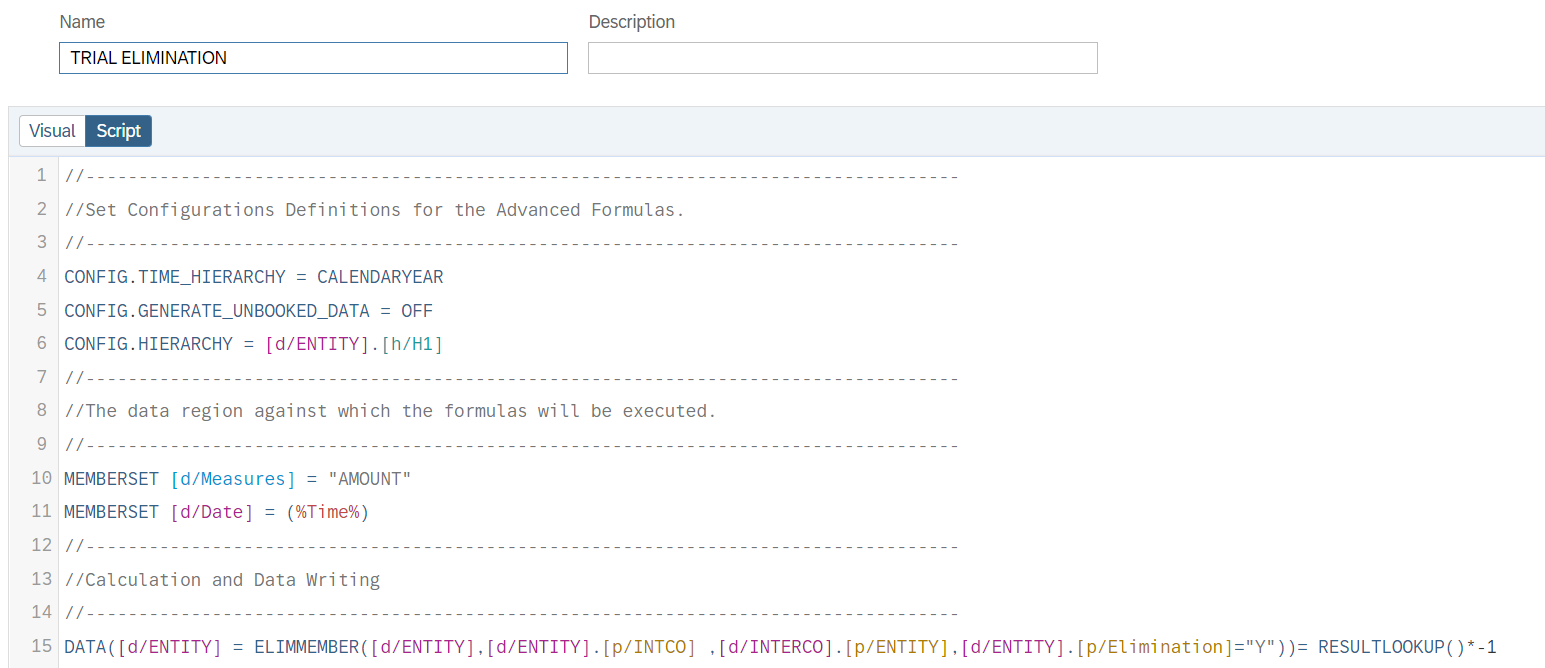

Step 3- Prepare a data action.

CONFIG.HIERARCHY = [d/ENTITY]. [h/H1] – Defines the hierarchy structure where [d/ENTITY] is at level H1.

MEMBERSET [d/Measures] = “AMOUNT”– give the instruction to the system to read the data from specified Measure.

MEMBERSET [d/Date] = (“%Time%”) give the instruction to the system to read the data from the time as specified by user.

DATA([d/ENTITY] = ELIMMEMBER([d/ENTITY],[d/ENTITY].[p/INTCO] ,[d/INTERCO].[p/ENTITY],[d/ENTITY].[p/Elimination]=”Y”))= RESULTLOOKUP()*-1

DATA([d/ENTITY]): This part defines “Organisation” type dimension

[d/ENTITY]. [p/INTCO]: Checks if the entity engages in intercompany transactions.

[d/INTERCO]. [p/ENTITY]: Involves intercompany entity relationships.

[d/ENTITY]. [p/Elimination] = “Y”: The entity is marked to post elimination amount.

RESULTLOOKUP()*-1 : Multiplies the Intercompany transactions by -1 and posts to the Elimination Entity

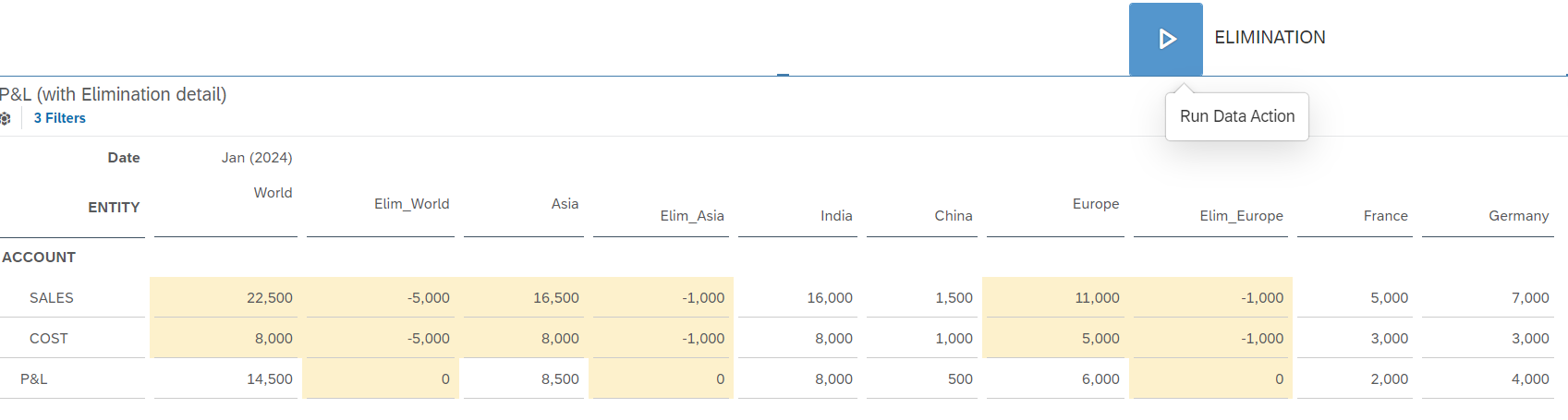

Step 4- Run the data action.

When an intercompany Elimination is triggered by user, Intercompany transactions are eliminated. For example, if India Ltd. sells goods worth 1000 to China Ltd., this transaction is eliminated at Elim_Asia.

Similarly, in transaction 2, if India Ltd. sells goods to France, the elimination effect will be shown at the Elim_world level.

Results

- Intercompany transactions between the common parent Asia are eliminated.

- Intercompany transactions between the common parent Europe are eliminated.

- Intercompany transactions between Europe & Asia are eliminated at World level.

Before Elimination:

After Elimination:

About the customer

- Customer is one of the leading pharma companies of India

- The customer has a complex organization structure with groups and sub-groups in multiple countries

- The group has several manufacturing facilities in India and abroad.

Solution Brief

- Implementation of end-to-end FP & A process (Monthly MIS)

- Planning of Revenue, OpEx, Capex, R&D Cost

- Implemented end-to-end legal consolidation process

- Currency conversion, IC eliminations

Outcomes

Significant reduction in consolidation time because of seamless data integration

Monthly/ Quarterly MIS pack is generated from BPC system

Management has complete control over the cost

Single click Reporting at entity, sub-group and group level

Higher accuracy because of minimal manual intervention

Single source of truth

SAP Technology Leveraged

- SAP BPC

- SAP BW

Project Timeline:

Jan-2022 to Nov.2022